Table Of Content

Our site has comprehensive free listings and information for a variety of financial services from mortgages to banking to insurance, but we don’t include every product in the marketplace. In addition, though we strive to make our listings as current as possible, check with the individual providers for the latest information. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan.

Mortgage options and terminology

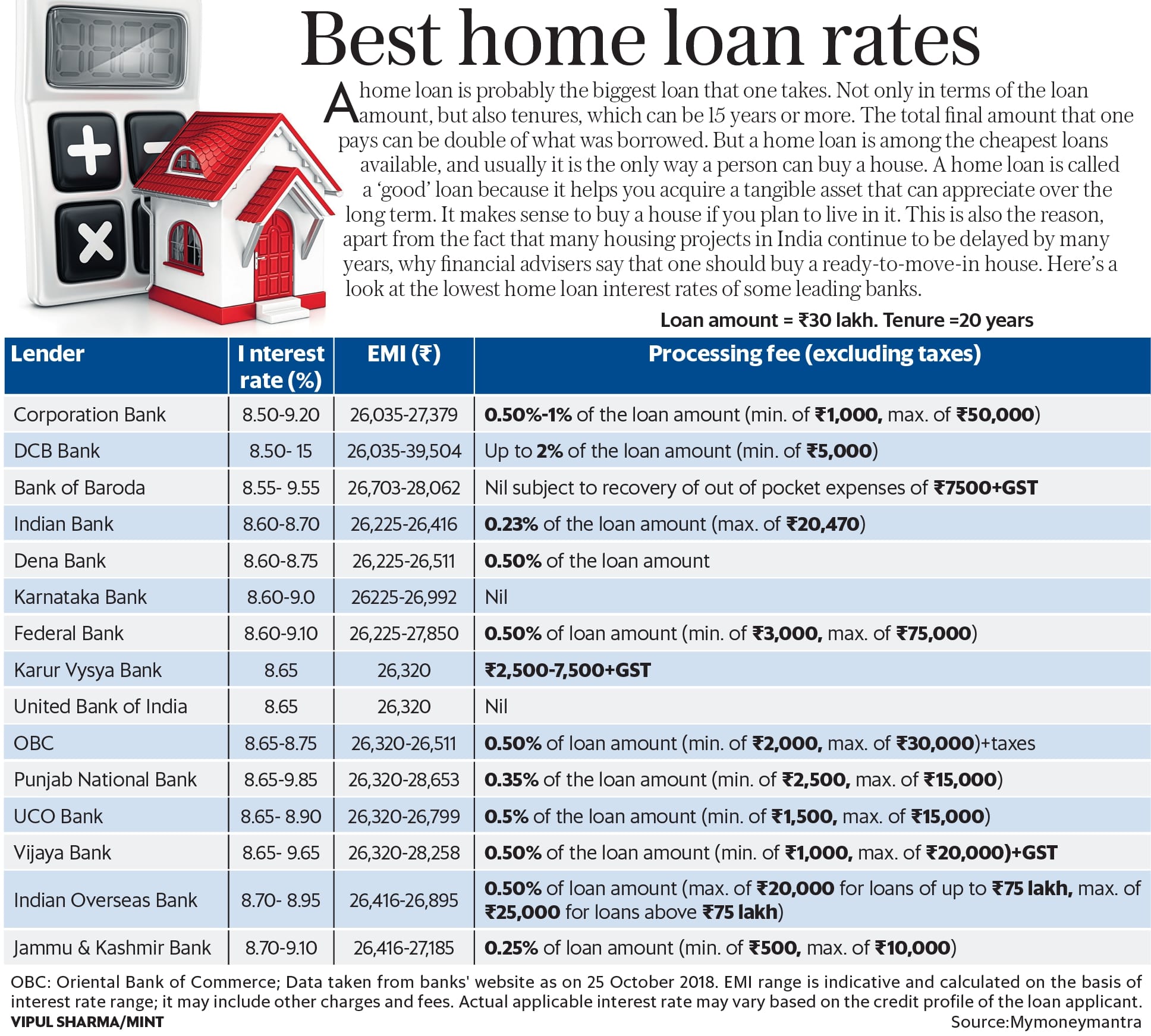

So far, inflation has slowed significantly, but it's still a bit above the Fed's 2% target rate. Borrowing costs above 7% have opened a chasm between the resale market and new-home market. Sales of previously-owned houses are struggling to gain momentum as potential buyers wait for interest rates to drop. ‘The average rate on a 30-year mortgage rose to 7.17% from 7.1% last week, mortgage buyer Freddie Mac said Thursday.

Other mortgage rates pages

A 5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment. The lengthy 30-year term allows you to spread out your payments over a long period of time, meaning you can keep your monthly payments lower and more manageable.

Insights from Economists: Detailed Predictions for Mortgage Rates in April 2024

The overall index of applications, which includes those for home purchases and refinancing, declined 2.7% last week. Top Fed officials themselves have said recently they could hold interest rates high for a while before getting full confidence inflation is heading down toward their target of 2%. Buying a house in California is a pricey proposition, but first-time homebuyers might qualify for grants or other forms of help. When you get pre-approved, you’ll receive a document called a Loan Estimate that lists all these numbers clearly for comparison.

Compare today’s mortgage interest rates – April 25, 2024 - CNN Underscored

Compare today’s mortgage interest rates – April 25, 2024.

Posted: Thu, 25 Apr 2024 12:25:06 GMT [source]

What Do Current Rates Mean for Refinancing in 2024?

When interest rates rise, reflecting changes in the economy and financial markets, so too do mortgage rates—and vice versa. Demand for mortgages can also affect rates, pushing them higher as available capital for lending tightens. Something deeply unusual has happened in the American housing market over the last two years, as mortgage rates have risen to around 7 percent. US mortgage rates increased to the highest level in five months, pushing down home-purchase applications for the fifth time in the last six weeks.

Who Are the Best Mortgage Lenders?

So to make sure you get the best mortgage rates is to apply with at least three lenders and see which offers you the lowest rate. The spring homebuying season is shaping up as a difficult one for buyers. Along with the recent surge in mortgage rates, home prices remain near record levels. When rates fall, that’ll spur demand, too, so you might want to get ahead of any potential rush into the market. Our advertisers do not compensate us for favorable reviews or recommendations.

The trade-off is that you'll have a higher rate than you would with shorter terms or adjustable rates. Bankrate has helped people make smarter financial decisions for 40+ years. Our mortgage rate tables allow users to easily compare offers from trusted lenders and get personalized quotes in under 2 minutes.

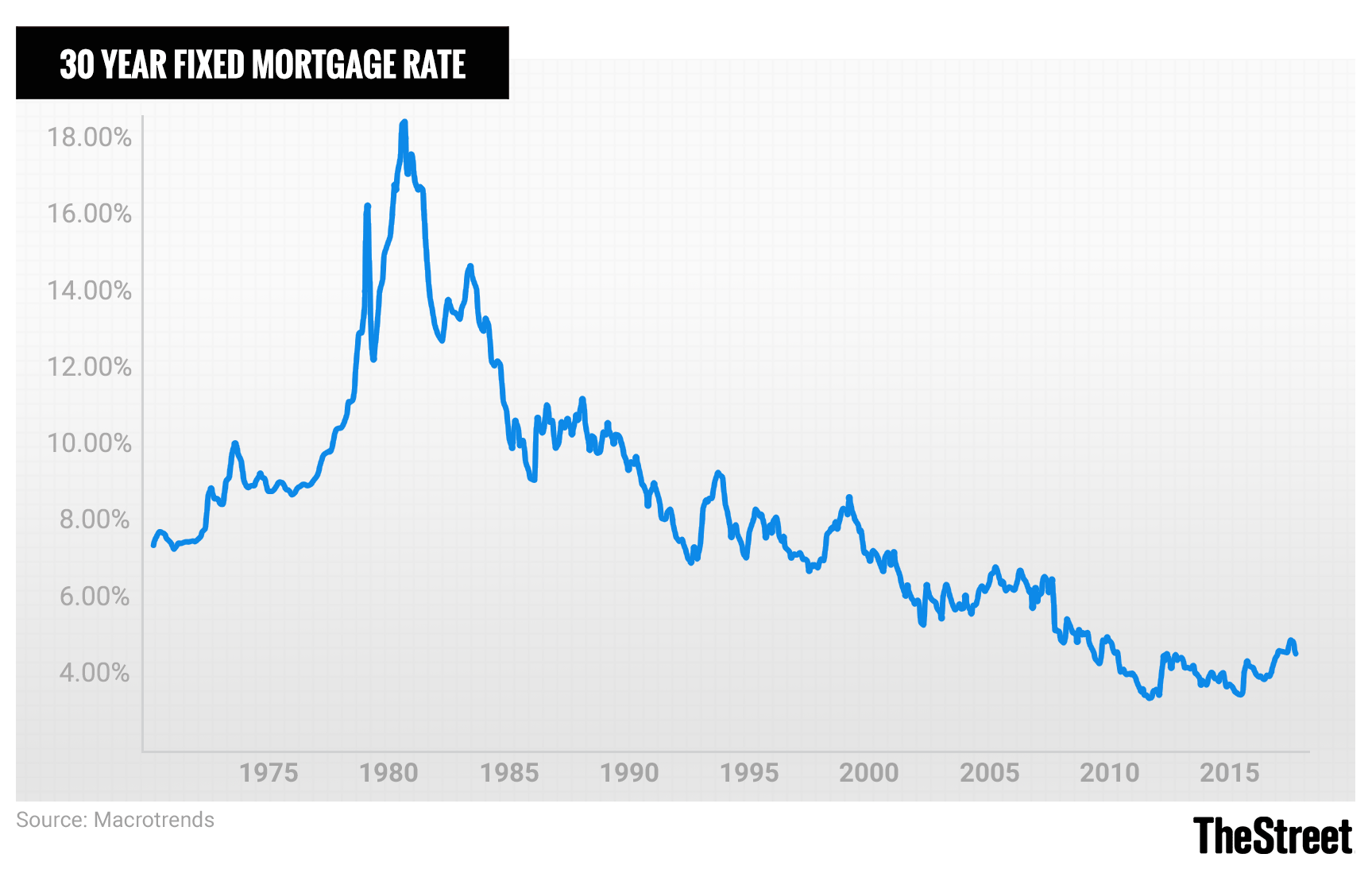

Editorial integrity

As we head into the spring home buying season, the 2024 outlook for mortgage rates is mainly optimistic, although most experts expect only a small decline. The Mortgage Bankers Association (MBA) anticipates that 30-year mortgage rates will range between 6.1% and 6.8% in 2024, a forecast echoed by NAR, which also predicts rates to hover within the 6.1% to 6.8% range. While the anticipation was for mortgage rates to recede in 2023, that wasn’t the case. Increases or decreases in 10-year Treasury yields directly influence 30- and 15-year mortgage rates. Currently, the Federal Reserve is actively buying 10-year Treasury notes, which increases the demand for these securities and drives their price up and yields down. So, our near record low mortgage rates are directly tied to the Federal Reserve Board's response to COVID-19 in efforts to keep financial markets open.

Sample loan programs

National mortgage rates edged higher for all types of loans compared to a week ago, according to data compiled by Bankrate. Rates for 30-year fixed, 15-year fixed, 5/1 ARMs and jumbo loans jumped. In addition to monetary policy, lenders also have an impact on mortgage rates. A lender with physical locations and a lot of overhead may charge higher interest rates to cover its operating costs and make a profit on its mortgage business.

Bankrate is an independent, advertising-supported publisher and comparison service. We arecompensatedin exchange for placement of sponsored products and services, or when you click on certain links posted on our site. However, this compensation in no way affects Bankrate’s news coverage, recommendations or advice as we adhere to stricteditorial guidelines. A fixed rate is when your interest rate remains the same for your entire loan term. An adjustable rate stays the same for a predetermined length of time and then resets to a new interest rate on scheduled intervals.

The Fed’s latest summary of economic projections maintained the three planned rate cuts for 2024, but Federal Reserve Chair Jerome Powell reiterated the timing of those rate cuts will depend on more inflation data. The FAIR Plan is a privately run insurer of last resort meant to provide coverage to those who can't get it from the traditional market. These plans typically cost property owners much more money on average and are only intended to provide temporary coverage for catastrophic events. Rates that high are not, by themselves, historically remarkable. The trouble is that the average American household with a mortgage is sitting on a fixed rate that’s a whopping three points lower. The Federal Reserve has increased the federal funds rate dramatically to try to slow economic growth and get inflation under control.

Supply chain shortages related to the pandemic and Russia’s war on Ukraine caused inflation to shoot up in 2021 and 2022. A resilient economy and robust job market also drive inflation higher and increase demand for mortgages. Finally, your individual credit profile also affects the mortgage rate you qualify for. Before joining Bankrate in 2020, I spent more than 20 years writing about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. I’ve had a front-row seat for two housing booms and a housing bust. I’ve twice won gold awards from the National Association of Real Estate Editors, and since 2017 I’ve served on the nonprofit’s board of directors.

While our priority is editorial integrity, these pages may contain references to products from our partners. Remember that average mortgage rates are only a general benchmark. If you have good credit and strong personal finances, there’s a good chance you’ll get a lower rate than what you see in the news. The average 30-year fixed mortgage interest rate is 7.30%, which is an increase of 18 basis points from one week ago. (A basis point is equivalent to 0.01%.) A 30-year fixed mortgage is the most common loan term.

According to the February 2024 Mortgage Monitor report, nearly half of the individuals who purchased homes last year stand to benefit from refinancing if rates drop to 6% or lower. As a borrower, it doesn’t make much sense to try to time your rate in this market. Our best advice is to buy when you’re financially ready and can afford the home you want — regardless of current interest rates.

For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower. Borrowers can get preapproved for a mortgage by meeting the lender’s minimum qualifications for the type of home loan you’re interested in. For example, a conventional mortgage usually has higher credit score and down payment requirements than government loans, such as Federal Housing Administration (FHA) and Veterans Affairs (VA) mortgages.

No comments:

Post a Comment